flow through entity taxation

Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience including work with or on behalf of companies like. In the end the purpose of flow-through entities is the same as that of the other.

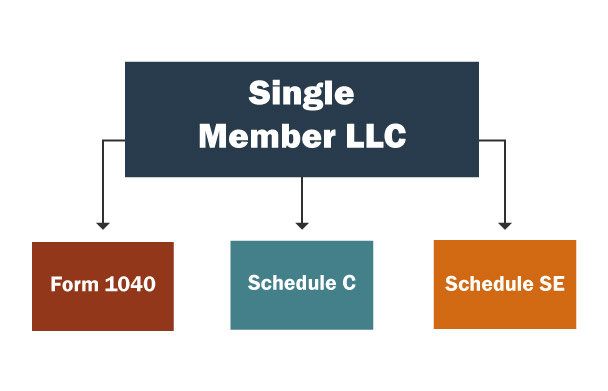

Llc Taxes Single Member Llc Taxes Truic

Debt Reduction Task Force Restoring Americas Future Bipartisan Policy Center November.

. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Well also discuss gift and transfer taxes and review rules governing the formation operation and disposition of. Flow-through entities are used for several reasons including tax advantages.

Instead all income is passed through to the owners who pay tax at. For more information on the sale of this type of property see. Through this arrangement business owners and shareholders only pay taxes on their personal income generated through this business and dont have to pay additional corporate taxes for running.

UpCounsel accepts only the top 5 percent of lawyers to its site. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. Learn about income taxation of various entity types.

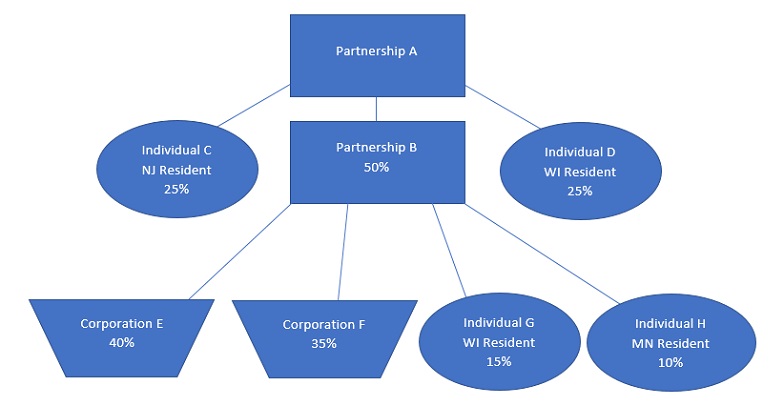

These major issues of how much income is taxable in each state apportionment and allocation of income as applied to partnerships the availability of composite returns and withholding on non-residents are discussed below in Sections V. This means that the flow-through entity is responsible for the taxes and does not itself pay them. Pass-through taxation refers to businesses that do not pay taxes on the entity level.

The main issues here are not so much status issues but the applications of taxation to the model of a flow through entity. The income of the business entity is the same as the income of the owners or investors. As a result only the individuals not the business are taxed on the revenue thereby avoiding double taxation.

Simple Fair and Pro-Growth. Idea three entity taxation should be applied when a vehicle carries on active business The US has a long history of using the third idea to determine which method of taxation applies. That is the income of the entity is treated as the income of the investors or owners.

Because the business does not pay an entity-level tax pass-through entities avoid double taxation. Flow-through businesses include sole. Flow-through entity - Wikipedia the free encyclopediaA flow-through entity FTE is a corporate legal entity where income flows through to investors unitholders in the form of regular cash distributions.

The Moment of Truth. The majority of businesses are pass-through entities. Example Question 1.

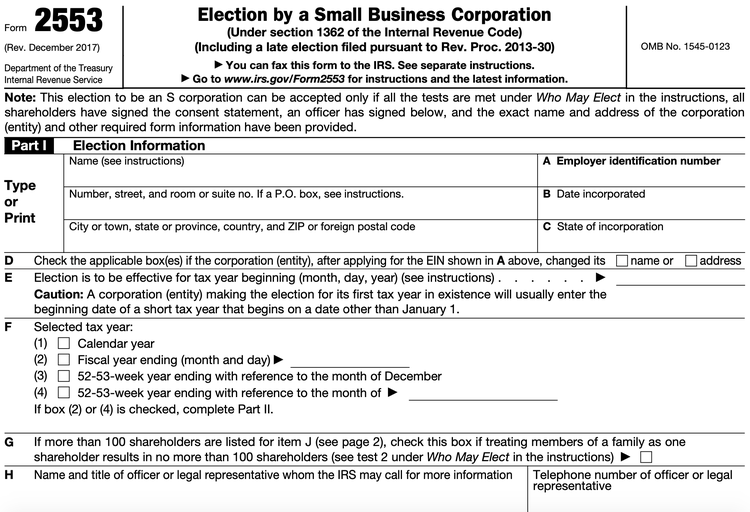

Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate. A pass-through entity allows a lot of flexibility because LLC owners can choose how their business will be taxed and still retain the benefits of a flow-through entity. Flow-through entities are considered to be pass-through entities.

A flow-through entity is also called a pass-through entity. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Understanding What a Flow-Through Entity Is.

If you need help understanding or planning an S corp flow-through taxation you can post your legal need on UpCounsels marketplace. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital gain you reported created an exempt capital gains balance ECGB for that entity.

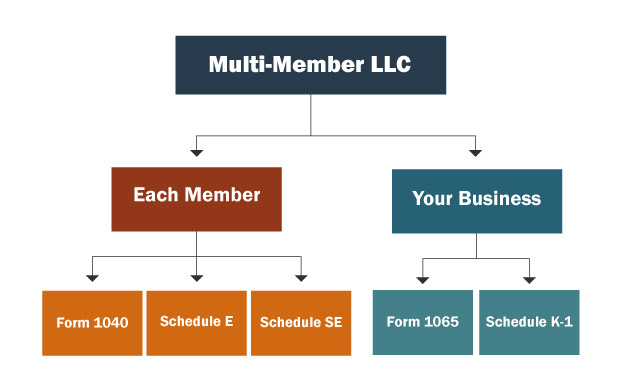

Same facts as the example above except that the business is an LLC taxed as a partnership. Common Types of Pass-Through Entities. For example from 1935 onwards carrying on active business caused a trust to be recharacterised as a company for federal income tax purposes.

Pass-through taxation typically applies to sole proprietorships partnerships and S-corporations as long as no exception applies. Strom acquired a 25 interest in Ace Partnership by contributing land having an adjusted basis of 16000 and a fair market value of 50000. Proposals to Fix Americas Tax System Report of the Presidents Advisory Panel on Federal Tax Reform November 2005.

This implies that the LLC owner reports all business income and losses on their personal tax returns. Flow-Through Entity is an organization it will be better to translate it as 过渡 公司机构. A flow-through entity is a legal entity where income flows through to investors or owners.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. Taxation for Corporations and Other Flow-Through Entities. A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation.

LLCs that have only one ownermember are taxed as sole proprietorships. The land was subject to a 24000 mortgage which was assumed by Ace. Flow-through entities are also known as pass-through entities or fiscally-transparent entities.

Report of the National Commission on Fiscal Responsibility and Reform December 2010. Corporations S and C LLCs sole proprietorships partnerships estates and trusts. Curious as to how flow-through entities work and whether or not one is right for you.

Taxation Of Flow Through Entities. The income of the owners of flow-through entities are taxed using the ordinary income rate. Instead the income passes to the owners of the business who pays personal income taxes for their share of the business.

Every profit-making business other than a C corporation is a flow-through entity including sole. When the business earns 100000 of income it is not taxed on the earnings.

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

9 Facts About Pass Through Businesses

9 Facts About Pass Through Businesses

How To Choose Your Llc Tax Status Truic

The Other 95 Taxes On Pass Through Businesses Econofact

Multi Member Llc Taxes Llc Partnership Taxes

Elective Pass Through Entity Tax Wolters Kluwer

Pass Through Business Definition Taxedu Tax Foundation

Pass Through Taxation What Small Business Owners Need To Know

Pass Through Entity Tax 101 Baker Tilly

What Are The Tax Implications For An Llc Effects Of Operating As An Llc

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

What Is A Pass Through Entity Youtube

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Entity Definition Examples Advantages Disadvantages

A Beginner S Guide To Pass Through Entities

Flow Through Entity Overview Types Advantages